A Core Financial Report

The Balance Sheet is one of the three core financial statements of a small or medium-sized business, along with the Profit and Loss Statement and the Cash Flow statement.

It reports a company’s assets, liabilities, and owners/shareholders’ equity at a point in time.

A standard balance sheet is considered to have a left side representing the company’s assets (what it owns) and a right side showing its liability and ownership equity (what it owes).

The balance sheet adheres to a formula that equates the total of the company’s Assets to the sum of the company’s total Liability and Equity: Assets = Liability + Shareholders’ Equity.

Assets: Assets are divided into current and non-current assets. Current assets include cash, accounts receivable, and inventory. Non-current assets include property, equipment, investments, and intangible assets. A general order is observed in this category, prioritizing the assets in order of liquidity or ease with which they can be converted into cash.

Liabilities: Liabilities are amounts that a business owes to third parties, whether internal (employees) or external (suppliers), including accounts payable, interests payable, wages, utilities, taxes, loans, and more.

Equity: Equity represents the amount attributable to the owners of a business or its shareholders. Retained earnings are earnings that the company reinvested in the business or used to pay off debt. The remaining amount is distributed to shareholders in the form of dividends.

Small Business Balance Sheet Template

Take the example of a loan that a small business receives—the cash on hand increases, which increases the asset. At the same time, the debt for the loan is recorded in the liability column, which increases the liability. The numbers changed, but the balance sheet “balances.”

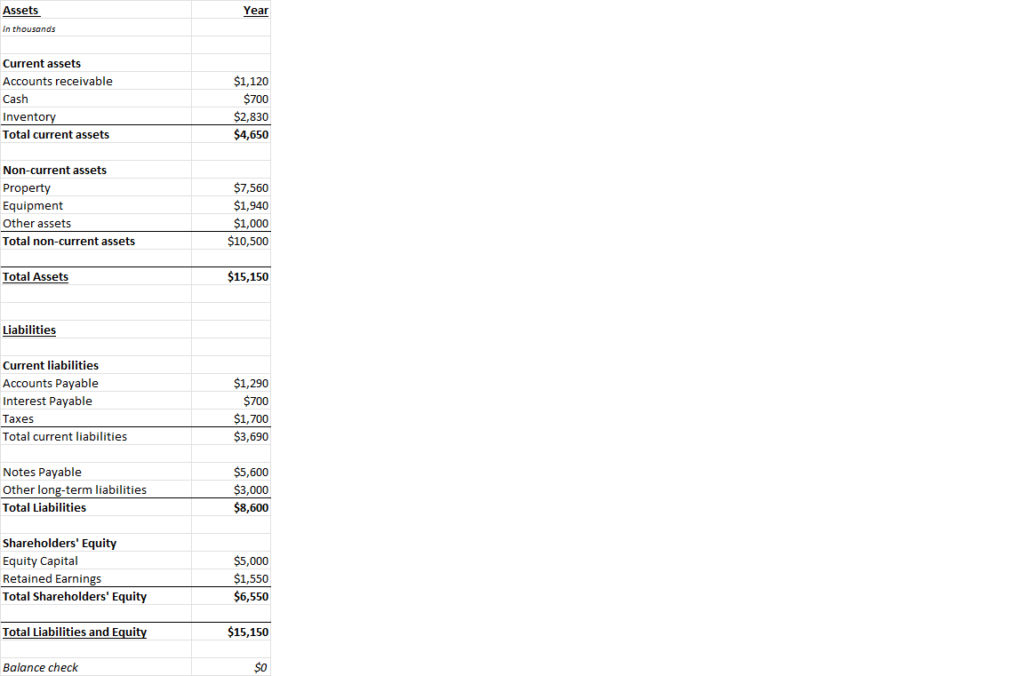

Here is an example of a balance sheet that you can customize to your needs:

Fig 1: Sample Balance Sheet Template for Small Business

Monitoring Your Company's Balance Sheet

The balance sheet provides an overview of the state of the small business at a moment in time. For this reason, it is best to compare it to those of previous periods. Doing so allows business owners to measure their company’s growth by comparing its performance with prior data or even industry averages.

Many ratios, such as the debt-to-equity ratio for example, are derived from the balance sheet. The debt-to-equity ratio compares a company’s total liabilities to its owner’s equity. It is calculated by dividing its total liabilities by its shareholder’s equity. In our example, the debt-to-equity ratio is 1.31 (8600/6550). Higher-leverage ratios tend to indicate higher risk.

Lenders rely on the balance sheet, especially for larger financings, to evaluate a business’s net worth and financial efficiency, amongst other metrics.

A strong balance sheet is helpful while applying for small business loans and will help your commercial loan broker assist you in securing better rates for your commercial financings.

The Balance Sheet is a report that every small business owner must track regularly. Whether to monitor the business’s financial performance or ensure that needed financing is available when required, a strong balance sheet will help.

If you would like BorrowPartner to send you a free, blank copy of the sample Balance Sheet statement template spreadsheet in Figure 1 above, contact us here.

BorrowPartner provides small businesses with easy, flexible, and rapid access to capital via an expansive selection of business financing solutions, all customized to your business needs.