A Core Financial Report

The Profit and Loss (P&L) statement is a financial report that summarizes the revenues, costs, and expenses incurred by a small business during a specified period.

P&L statements are often called Income Statements, Earning Statements, or Statements of Operations.

These reports indicate how businesses convert revenues into Net Income and whether companies generate profit or loss over time.

Profit and loss statements are usually generated yearly, quarterly, or monthly.

Small business P&L statements, Balance Sheet Statements, and Cash Flow statements are the three core financial reports used and issued by corporations. When used together, they give an in-depth assessment of a company’s financial performance.

Compared with prior periods, they reflect even better insight by providing account-level financial changes of a company over time.

Profit and Loss statements only report tangible items; they do not account for non-tangible items of value, such as a company brand.

Small Business Profit and Loss Template

The P&L statements follow a set format.

They begin with an entry for Revenues (also called Sales or Top Line). From there, they subtract amounts spent on the Cost of Goods Sold (for product-based businesses) and deduct the Operating Expenses, Interest Expenses, and Tax Expenses. The balance is the Net Income of the company, commonly referred to as the “bottom line.”

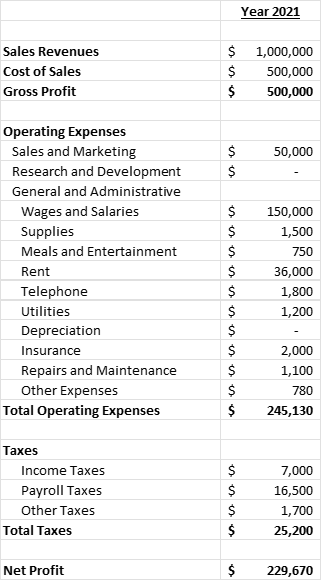

Below is an example of a small business Profit and Loss Statement that can be used as a template for a company selling products.

Fig 1: Sample Small Business Profits and Loss Statement Template

Accounting Methods

Profit and Loss statements are prepared differently depending on whether a small business follows the Accrual or Cash Method of accounting.

The two methods direct how and when income and expenses are recognized.

The Accrual method recognizes revenues and expenses when earned and invoiced. In other words, small businesses using this method record revenue when sales are made rather than when payments are received. Similarly, these businesses record expenses when purchases are made and invoiced to the company rather than when payments are subsequently sent to their vendors to settle invoices.

Conversely, the Cash method, used mainly by small businesses, recognizes revenues and expenses when monies go in or out of the company. In other words, small businesses using this method only record revenues when they receive payment for their sales. Similarly, these businesses only record the expense for purchased items when they pay their provider.

Monitoring Your Company's Profit and Loss

Managers and investors use P&L reports to measure businesses’ financial performance and profitability.

Small business lenders use that information to assess a company’s ability to generate cash flow and repay its debt over time.

BorrowPartner provides businesses with easy, flexible, and rapid access to financing solutions, all customized to your business needs.